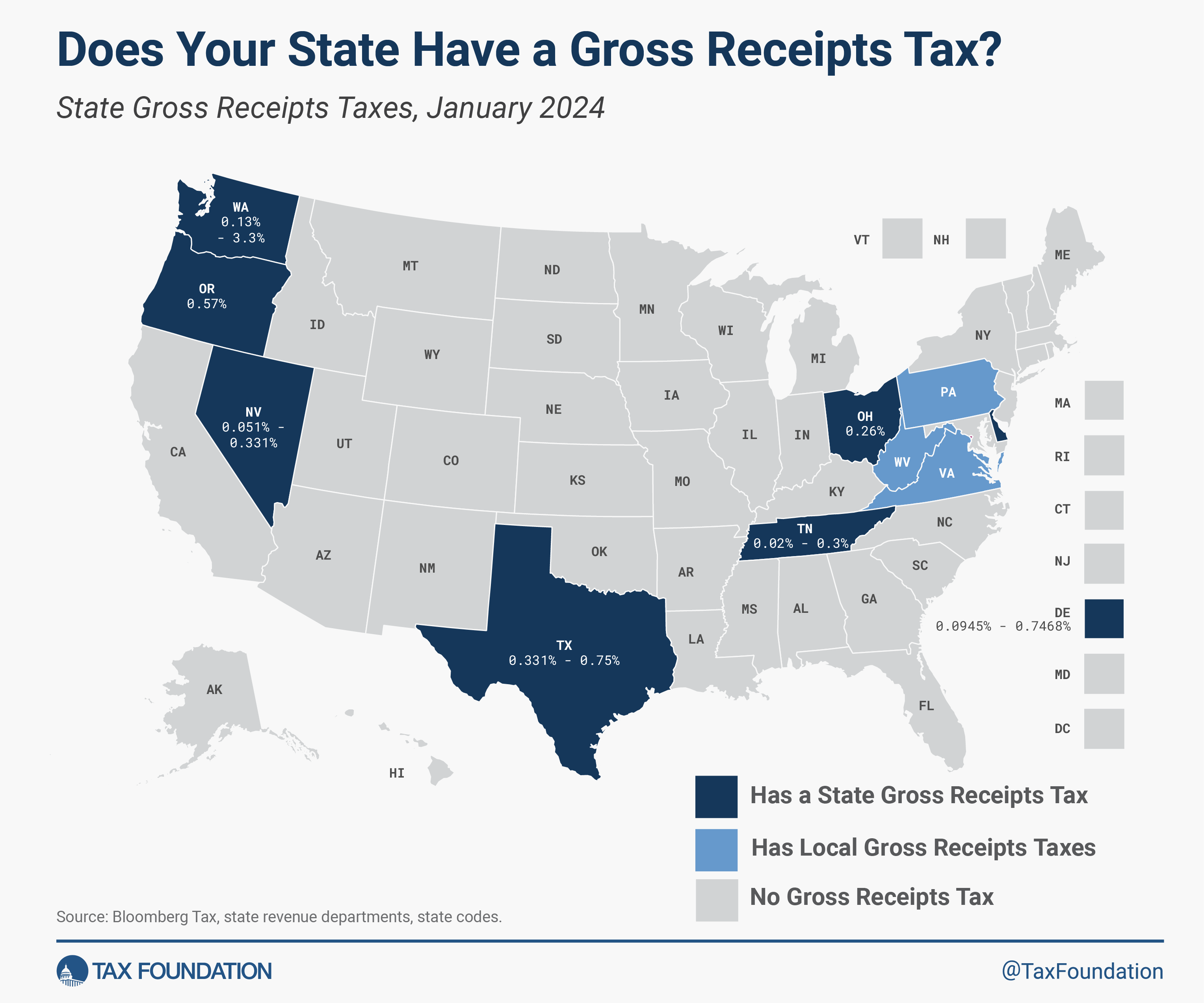

Does Your State Have a Gross Receipts Tax?

The text discusses gross receipts taxes, which are imposed on businesses based on their gross sales before deducting operating costs. Seven states have a state-level gross receipts tax, while three allow municipalities to assess it locally. Gross receipts taxes have a long history but have fallen out of favor in recent decades. States often differentiate tax rates based on industry or revenue levels. Some states, like Nevada and Washington, have poorly structured gross receipts taxes that are legally problematic. Ohio and Oregon have recently made changes to their gross receipts taxes. Overall, the text argues that gross receipts taxes are harmful and should be replaced with a well-structured corporate income tax.