Whitehouse: Our Tax Code Is Corrupted and Rotten | U.S. Senate Committee On The Budget

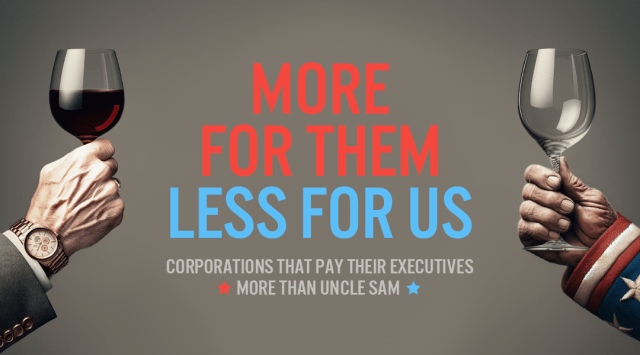

“It’s not enough just to undo the damage of the Trump tax law—our tax code wasn’t fair before that,” said the Chairman of the Budget Committee Washington, D.C.— U.S. Senator Sheldon Whitehouse (D-RI), Chairman of the U.S. Senate Budget Committee, delivered the following opening statement at today’s hearing, titled “Making Wall Street Pay Its Fair Share: … Read more