2.5% increase in global natural gas demand in 2024 says IEA

At the beginning of next week, the Ministers of Finance and Energy, Makis Keravnos and Giorgos Papanastasiou, respectively, will have a meeting, during which it will be decided, as informed by KYPE, whether the Republic of Cyprus will participate or not and with what amount in the Great project Sea Interconnector (formerly EuroAsia Interconnector), which concerns the electrical interconnection, in the first phase, of Cyprus – Crete and, in the second phase, with Israel.

After taking any decision taken at the meeting of the two Ministers, the Minister of Energy, according to the same information, will submit a relevant proposal to the session of the Council of Ministers, which will be held under the President of the Republic next week, to be approved.

It is noted that last Tuesday, January 23, an international firm presented the study it carried out for the Great Sea Interconnector and which positively evaluates the entire project, thus strengthening the possibility that the Republic of Cyprus will participate in the project.

The company's evaluation showed that the Great Sea Interconnector will have "a great value for the electricity market of Cyprus and at the same time a very high geopolitical value", due to the fact that Cyprus will be in the middle of the interconnection of the national electricity networks of Israel and Greece and according to expansion of Europe.

As the Minister of Energy had previously stated at KYPE, after the presentation of the study "the decision of the Republic of Cyprus to participate or not in the whole project will be taken immediately" and then the corresponding message will be given to the Independent Electricity Transmission Operator (ADMIE ) which is the implementing body of the project.

He also said that the period of time that the Republic of Cyprus has set to take its decision is until January 31, 2024, and added that after the decision, a similar message will be given to the ADMIE of Greece, which is the implementing body of the entire project.

Mr. Papanastasiou explained that ADMIE will create a special purpose vehicle (Special Purpose Vehicle) and then will follow the issue of share capital for which there will be interest in participation.

The Republic of Cyprus is expected to participate in the equity capital with €100 million included as a loan through the Recovery and Resilience Plan.

However, interest in investing in the Great Sea Interconnector project was also expressed by the Investment Fund of the United Arab Emirates (TAQA) during the meeting held on Friday morning by the CEO of TAQA, Jasim Husain Thabet and members of the investment fund with the President of the Republic, Nikos Christodoulidis at the presidential palace.

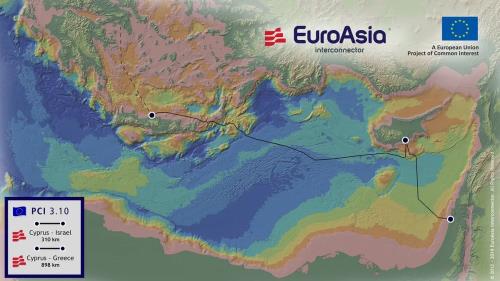

The Great Sea Interconnector concerns the interconnection of the national electricity transmission networks of Cyprus, Israel and Greece (via Crete), with a capacity of 2,000 MW.

2.5% increase in global natural gas demand in 2024 says IEA

Natural gas demand is recovering as a result of expected cooler weather and lower prices, and will show growth in 2024 by 2.5% or 100 billion cubic meters (bcm), the International Energy Agency (IEA) said in its latest report, noting , however, that limited new liquefied natural gas (LNG) production will result in supply remaining tight.

Global gas demand growth is expected to accelerate this year due to cooler winter temperatures and deflationary prices, with emerging economies leading consumption growth, but geopolitical risks and supply-side concerns could cause fresh price volatility, according to the IEA's latest gas market report titled "Global gas demand expected to grow more in 2024 despite heightened geopolitical uncertainty."

The report finds that low-emissions policy momentum is being strengthened, with increased emphasis on the role of hydrogen, biogas and biomethane in supporting countries to meet energy and climate targets.

According to the IEA, in 2023 global natural gas demand grew by just 0.5%, as growth in China, North America and gas-rich countries in Africa and the Middle East was partially offset by a decline in other areas.

“As pandemic restrictions eased and economic activity returned, China regained its position as the world's largest LNG importer (although China's LNG imports in 2023 were still below 2021 levels) , as natural gas demand increased by 7%," he adds.

In contrast, he continues, natural gas consumption in Europe fell by 7%, reaching the lowest level since 1995.

It says the decline was exacerbated by the rapid expansion of Renewables and the increased availability of nuclear power that weighed on demand for natural gas in both Europe and mature Asian markets, driving prices lower.

"The expected colder winter in 2024, compared to the unusually mild temperatures experienced in 2023, is likely to cause an increase in demand for heating," he adds.

It also reports that natural gas prices have fallen significantly, following the historic highs reached in 2022, which also supports the recovery in natural gas demand.

"Although prices remain well above historical averages, demand in price-sensitive industrial sectors will return to growth," according to the report.

In power generation, the IEA says, natural gas use is projected to increase only marginally, as higher natural gas burning in the Asia-Pacific, North America and Middle East region is projected to be offset, in part, by reduced demand in Europe .

On the supply side, as reported by the International Energy Agency, natural gas availability remained relatively tight in 2023 as the increase in global LNG production was not enough.

Therefore, he continues, the increase in production was not sufficient to offset the ongoing decline in Russian pipeline gas deliveries to Europe.

Supply growth was also highly concentrated geographically, with the United States becoming the world's largest LNG exporter, accounting for 80% of additional LNG supply in 2023, it adds.

Geopolitical uncertainties

According to the IEA report, "geopolitical uncertainties are the biggest risk factor for global natural gas markets in 2024."

"Russia's invasion of Ukraine, heightened tensions in the Middle East and concerns about deliberate interference with critical infrastructure such as pipelines have the potential to create further instability," he underlines.

It also states that in 2023, policy measures and new regulations were introduced in key import markets with emphasis on affordability and security of supply.

According to the IEA, the European Union has launched the common gas market mechanism, Japan has started its strategic liquefied natural gas buffer stockpile ahead of the 2023/24 winter season, and China is formulating its natural gas policy, setting guidelines authorities for a "smooth increase in natural gas demand" in the coming years.